Lerner and Rowe Injury Attorneys

From Wreck to Check™

The most valuable non-legal service we provide is to carry the emotional burden for our clients so that they can focus on recovery.

What Our Clients Have to Say

NAMED #2 MOST INFLUENTIAL FIRM IN AMERICA!*

We’ve Helped Over 150,000 Clients You Can Trust Us to Help You Too

$10,000,000

Motorcycle Accident$10,000,000

Pedestrian Accident$5,500,000

Auto Accident$3,850,000

Auto Accident$3,025,000

Auto Accident$3,025,000

Auto AccidentPut Our Compassionate

Legal Team to Work for You

- Award-Winning Personal Injury and Wrongful Death Attorneys.

- Over 240 years of combined litigation experience devoted to personal injury.

- Board Certified Injury and Wrongful Death Specialist on staff.

- Attorneys and support staff fluent in both English and Spanish

- Our legal team is trial ready and gets results! We have recovered billions for our injured clients.

- Trusted by over 150,000 satisfied clients and positive reviews.

- Our award-winning legal team provides top quality service.

- The most valuable non-legal service we provide is to carry the emotional burden for our clients so that they can focus on recovery.

- Our caring staff is invested in the well-being of our local communities, as demonstrated through our ongoing volunteer work and the donation of hundreds of thousands of dollars to charity annually.

Lerner and Rowe Personal Injury Attorneys’ Locations

We are licensed to practice in the highlighted states; however, we work with other law firms in almost all 50 states.

WE WILL COME TO YOU

Schedule a free, no obligation personal injury consultation with us 24/7. Just submit a FREE online case review form, chat with a live representative or call us toll free nationwide 844-977-1900.

Radio host and #LovePup Foundation co-founder, Johnjay Van Es, endorses Lerner & Rowe.

Listen Now Listen Now

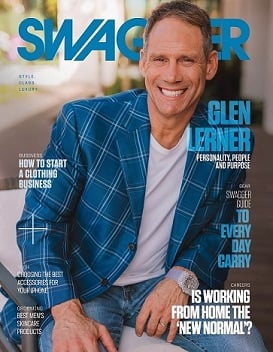

Glen Lerner and Kevin Rowe Featured on the Front Cover of Scottsdale Airpark News

Read Full Interview